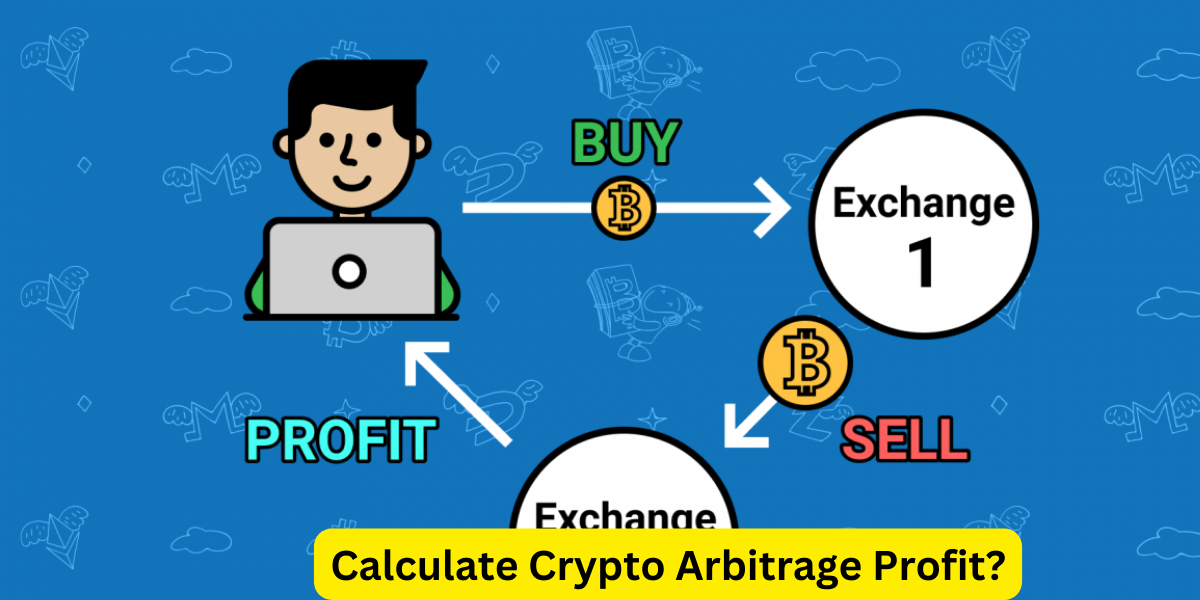

Step-by-Step Tutorial: How to Calculate Crypto Arbitrage Profit?

We will walk you through the process of calculating crypto arbitrage profit in this step-by-step tutorial.Trading cryptocurrencies has been extremely popular recently as a result of investors looking for strategies to increase their profits in this erratic market. Crypto arbitrage is one tactic that has caught the attention of many traders.This book will assist you in comprehending and successfully using arbitrage trading, regardless of your level of trading experience or familiarity with the cryptocurrency market.

What is crypto arbitrage?

Crypto arbitrage refers to the practice of taking advantage of price differences between different cryptocurrency exchanges. Essentially, it involves buying a cryptocurrency on one exchange where the price is low and then selling it on another exchange where the price is higher. This can be done manually by monitoring multiple exchanges and executing trades quickly, or it can be automated using special software.

How does crypto arbitrage work?

Crypto arbitrage works by exploiting the time lag it takes for prices to adjust across multiple exchanges. Here’s a simplified step-by-step process:

Step 1: Choose Your Cryptocurrency Exchanges

To get started, select two or more cryptocurrency exchanges that list the cryptocurrency you want to arbitrage. Ensure that these exchanges have a good reputation, high trading volume, and quick withdrawal and deposit processes.

Step 2: Deposit Funds

Deposit your chosen cryptocurrency into your accounts on the selected exchanges. You’ll need to have sufficient funds to execute arbitrage trades effectively.

Step 3: Monitor Price Discrepancies

Use cryptocurrency tracking tools or real-time data from the exchanges to monitor price variations. Look for opportunities where the same cryptocurrency is trading at a lower price on one exchange and a higher price on another.

Step 4: Execute Buy and Sell Orders

When you identify a profitable arbitrage opportunity, initiate a buy order on the exchange with the lower price and a sell order on the exchange with the higher price. Ensure that your orders are executed quickly to capitalize on the price difference.

Step 5: Calculate Arbitrage Profit

Calculate your profit by subtracting the total expenses (including fees) from the revenue generated by selling the cryptocurrency at a higher price. The resulting amount is your arbitrage profit.

8. Factors to Consider

When engaging in crypto arbitrage, several factors can influence the success of your trades. These include:

- Market volatility

- Transaction fees

- Withdrawal limits

- Exchange reliability

- Security measures

- Timing of trade execution

9. Risks Associated with Crypto Arbitrage

While crypto arbitrage can be profitable, it’s essential to be aware of the risks involved. These risks include:

- Price volatility

- Liquidity issues

- Exchange downtime

- Regulatory changes

10. Tax Implications

Depending on your jurisdiction, arbitrage profits may be subject to taxation. It’s crucial to understand the tax implications of your trades and report your earnings accordingly.

11. Is crypto arbitrage legal?

The legality of crypto arbitrage varies by country. Some nations have regulations in place, while others do not. Ensure you comply with your local laws and regulations when engaging in arbitrage trading.

12. Tips for Successful Arbitrage Trading

To enhance your chances of success in crypto arbitrage, consider the following tips:

- Use multiple exchanges

- Keep funds on standby

- Stay updated on market news

- Execute trades promptly

13. Common Mistakes to Avoid

Avoid these common mistakes when participating in crypto arbitrage:

- Neglecting fees

- Underestimating transfer times

- Ignoring security measures

- Failing to account for taxes

How do I find the best cryptocurrency exchanges for arbitrage trading?

Are you looking to get into cryptocurrency arbitrage trading but not sure where to start? Don’t worry, we’ve got you covered. In this article, we’ll give you some tips on how to find the best cryptocurrency exchanges for arbitrage trading.

Firstly, it’s important to understand what arbitrage trading is. Essentially, it’s the practice of buying and selling assets simultaneously on different markets in order to take advantage of price discrepancies. In the case of cryptocurrency, this means buying a coin on one exchange where it’s undervalued and selling it on another exchange where it’s overvalued.Now that we have that out of the way, let’s talk about how to find the best exchanges for arbitrage trading.

Here are some tips:

Look for exchanges with high trading volumes.The more trading volume an exchange has, the more likely it is that there will be price discrepancies between different markets. This is because there are more buyers and sellers on the exchange, which can lead to different prices for the same coin.

Check for price discrepancies between exchanges.Before you start trading, make sure to compare prices across different exchanges. You can use websites like CoinMarketCap or CoinGecko to see the prices of different coins on different exchanges. Look for coins that are priced differently on different exchanges, as these are the ones you can potentially make a profit on.

Consider the fees.Arbitrage trading can be a profitable strategy, but it can also be costly if you’re not careful. Make sure to take into account the fees charged by each exchange before you start trading. Some exchanges charge high fees for withdrawals or deposits, which can eat into your profits.

Look for exchanges with fast transaction times.In order to take advantage of price discrepancies, you need to be able to move your coins quickly between different exchanges. Look for exchanges that have fast transaction times and low confirmation times, as this will allow you to execute trades quickly and efficiently.

Do your research.Finally, make sure to do your own research before you start trading. Look for reviews of different exchanges online and talk to other traders to get their opinions. This will help you find the best exchanges for arbitrage trading and avoid any potential scams or pitfalls.

best arbitrage trading platform?

- ArbitrageScanner. ArbitrageScanner.io is the only bot in the world that supports more than 75 exchanges and tracks the difference between DEX and CEX exchanges, where spreads are 10–20% on large coins, making the project the best among its analogs.

- Cryptohopper Cryptohopper is a cloud-based cryptocurrency trading bot platform. It allows users to automate their trading strategies across multiple exchanges, including Binance, Coinbase Pro, Kraken, and more. With Cryptohopper, users can create custom trading strategies using a range of technical indicators and signals and then let the bot execute trades automatically based on those strategies.

- Trality Trality is a platform for creating and executing trading bots for cryptocurrency markets. It allows users to build bots using Python code or a visual editor and then deploy them on supported exchanges such as Binance, Bitpanda Pro, and Kraken. Trality also offers a range of pre-built strategies that users can customize to their liking. One of the unique features of Trality is its ability to run bots directly on the exchange, which can result in faster execution times compared to other bot platforms.

- Bitsgap Bitsgap is a powerful cryptocurrency trading platform that offers a variety of tools and features to help traders automate their trading strategies and improve their performance.Wide range of trading bots and smart order tools.Supports over 30 cryptocurrency exchanges.Compatible with a variety of trading tools.Free trial available; affordable pricing

- 3Commas 3Commas is a cryptocurrency trading platform that offers a variety of tools and features to help traders automate their trading strategies. It is one of the most popular trading bot platforms available, and it is compatible with over 20 cryptocurrency exchan

- Pionex Pionex is a cryptocurrency exchange that offers a variety of trading bots and tools to help traders automate their trading strategies. It is one of the few exchanges that offer built-in trading bots, and it offers a wide range of bots to choose from, including grid bots, DCA bots, and arbitrage bots.

Crypto arbitrage can be a lucrative trading strategy when executed correctly. However, it comes with risks and requires careful planning. By following the steps outlined in this tutorial and staying informed about market conditions, you can potentially profit from crypto arbitrage opportunities.

15. Frequently Asked Questions (FAQs)

Q1: How much capital do I need to start crypto arbitrage trading? A1: The amount of capital needed depends on the cryptocurrency you plan to trade and the exchanges you use. It’s advisable to have a significant amount of capital to maximize profits.

Q2: Can I arbitrage trade with any cryptocurrency? A2: While arbitrage opportunities exist for many cryptocurrencies, the most significant opportunities often involve well-known and highly liquid coins like Bitcoin and Ethereum.

Q3: How quickly should I execute my arbitrage trades? A3: Speed is essential in arbitrage trading. Aim to execute your trades as quickly as possible to minimize the risk of price changes.

Q4: Are there any tools or software that can help with crypto arbitrage? A4: Yes, there are various arbitrage trading bots and tools available that can automate the process and help you identify profitable opportunities.

Q5: What should I do if I encounter technical issues during an arbitrage trade? A5: Contact the customer support teams of the respective exchanges immediately. Quick resolution is crucial in arbitrage trading.